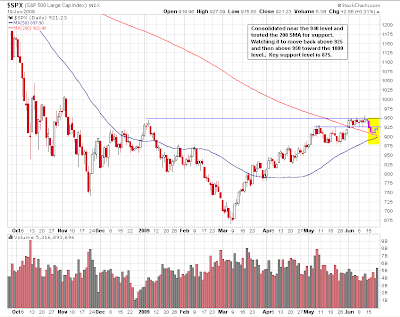

I’m not saying the SP500 could not be forming a head & shoulder pattern. From the SP500 daily chart, I have illustrated the SP500 can just as easily be forming a ‘W’, double bottom pattern from the current price actions.

The point is who is to know what price pattern the SP500 will form until it has made that pattern. All one can do is be on the lookout for possible price pattern and have trading plan ready if a particular price pattern developed. Another key point to remember is the market rarely do what everyone is expect it to do. Therefore, if majority of the market participants are expecting a H&S pattern, then the likelihood for it to form the H&S will be low.

What difference does it makes for what pattern it will form, you might ask. The difference is SP500 rises to 1000 or the SP500 falls to 800. Therefore, if you are listening to the talking heads and playing the market as it is going to form a head & shoulder, then you will be ripped if those talking heads’ prediction is incorrect.

Who is to say these talking heads can’t be right. If these talking heads continue guessing, one of these days, they will guess right. After all, the market is all about probabilities. To win, we just need to learn how to play the edge and manage risk. Guessing is not an effective way to gain an edge or manage risk. While the market is being indecisive, I will trade cautiously with reduced position size and tighter stop.