The market not only resilient, but it is also defiant. After the disappointed earnings report from MSFT, AMZN and AXP on last Thursday, one would have thought the market would be down last Friday. Think again, the market will humble us every time when we believe we got it all figured out. Instead of a down day on Friday, the DJIA and SP500 continue to move up, and the only thing that the disappointed earnings did was to halt the recent Nasdaq's winning streak to 12.

Today with the market trading down, it gave the appearance that the awaited pullback finally has arrived. Once again, the market defies us by regaining all its losses and closed with a modest gain for all three major indexes, DJIA, SP500, and the Nasdaq 100.

By any technical standard, the market is over extended and it is due for a pullback. But we all know whenever the herd is expecting the market to do something, the market will remind us who is in charge by doing the contrary.

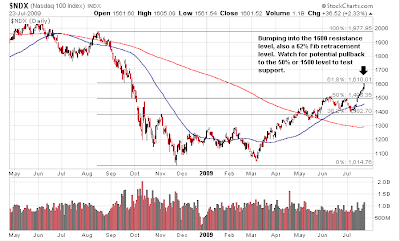

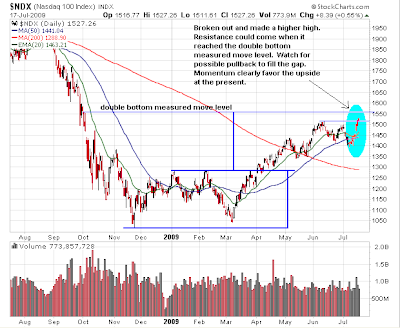

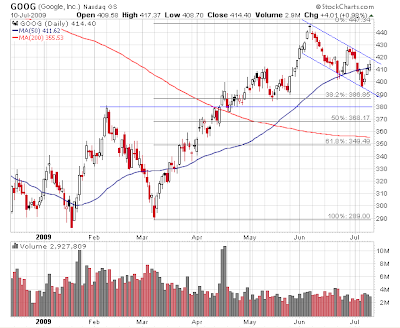

Here are the updated charts, click on them to see what are some potential resistance levels.

Instead of fighting the tape and trying to outwit the market, I will keep trading with the trend until the market tells me to do otherwise. If I feel a bit hesitant, I will reduce my position size and tighten my stop. If I'm in doubt, I will stop trading until it is clear. This is a much better strategy than shorting this market and have the stops blown away by those buy-the-dip rallies. Yes, I still believe this is a bear market rally, but that doesn't mean I will stop trading the uptrend if that is the prevailing trend.

I will stick with my scenario until the market tells me to change course. I do not make money by correctly calling the market direction, I make money by being on the right side of the trade. Therefore, when in doubt, stop trading.