1/6/2011 Updates:The trade was not stopped out today. If the breakeven stop was placed at the trigger level of $59.86 after a partial profit was taken near $62 yesterday, then today’s intraday low of $59.80 would have triggered the stop and closed out this trade. Today’s price action illustrates the importance on avoid placing stop near obvious support or resistance levels.

Today’s price action also setup a baseline near $62 for it to break in order to have a chance on reaching the 2nd target level of $64 and possibly breaking the downtrend.

Here is today’s intraday 5 minutes chart highlighting some key levels:

1/5/2011:

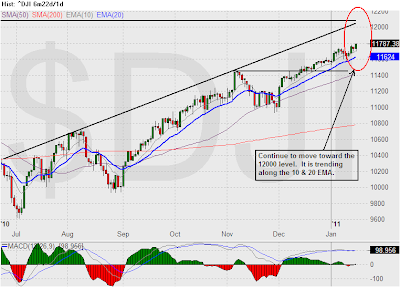

1/5/2011:Three trading days into a brand new year and the market has already reminded us who is in charge. In the first trading session of 2011, stocks opened with a bang and reached their resistance level (target level) in one big opening move, then in the second trading session similar strength was demonstrated on the opening but this time stock prices faded and ended up giving back most if not all the previous day’s gain. Finally, today the market reverted to its ascend and closed with a gain. Here is the latest SP500 chart. Target level remains to be near 1300.

SP500:

Throughout 2011, I will post some of my trades and my trade analysis to help me improve my trading discipline. By posting some of my trades in public, I hope it will subconsciously make me trade little more defensively with better discretions.

Here is my first trading post for this year. RIMM was one of the stocks in my ‘swing long triggered’ list today. From the following weekly price chart, RIMM has been trending downward since the middle of 2009 to the present. It has been trading methodologically within the declining price channel.

RIMM - weekly:

Recently, after it hit the resistance from upper channel trend line, the retracement back to the lower channel trend line present a swing long trade opportunity similar to the one in April of 2010. As the confluence of different rising moving average converge toward a price level, it sets up a swing long trade. In this case, the trigger from the daily price chart is the high of the candle prior to the setup candle ($59.86), and the stop loss is somewhere between the setup candle’s low and slightly below $58 (I never set my stops at the whole number levels since these levels are like magnet and they will likely be hit.) The targets are 62 & 64.

RIMM - daily:

From the 5 minutes intraday chart, it shows RIMM spent more than three hours trading near the R1 pivot level of 59.63. As the last hour of trading approaches, RIMM broke above the $59.90 baseline level with increasing volume and it reached the $62 target level prior to the closing bell. As it hit the $62 target level, took profits on 1/2 of the position with a slightly more than +1R and move the stop to breakeven for the remaining 1/2 of the position to setup a risk free trade for the remaining position.

RIMM - 5 minutes intrady:

With the surging volume and having the price close near the upper trend line, there is a high probability RIMM will breakout from the price channel and reach the 2nd target level of $64. I will post updates as this trade progresses.