The market continues to move higher after a brief consolidation near the resistance level. The Dow Jones Industrials consolidated around the 11600 then surged to the 11897 level. Tested this level for resistance couple time and then it breaks out and moving toward the next potential resistance near 12385.

The SP500 also consolidated near the 1220 level after it has rallied from the failed breakdown of the 1101 August low, and then it breaks toward the level in play, which is the 1260. When it broke above the 1260 level, it didn’t waste any time to move up to the 1296. With the current price action momentum, it is very likely the SP500 will bounce up to the 1345 level once it has moved above the 1296 resistance.

The Nasdaq 100 moved above the 2368 resistance level and heading toward 2438 even with some weak price action from AAPL.

The Russell 2000 moved above 738 and immediately surged to the 773 level. Now the sight is set on 816 as a potential target.

The gold ETF, GLD broke the baseline of a double bottom (or a ‘W’) pattern and looks like it is trying to fill the mid-October gap. The next potential resistance is near the 173 level.

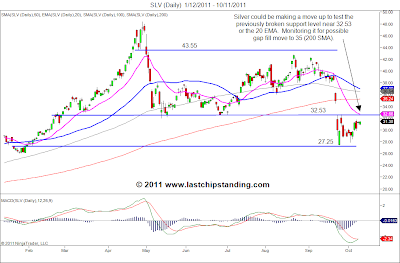

The silver ETF, SLV also showing it is trying to fill a gap made in mid-October. It came 7 cents shy of filling the gap. If it proceed to break above the 50/100/200 SMA, look for possible move up to 38 and filling another gap made in mid-October.

AAPL did what it might do prior to earnings report, it moved to a new high and priced the stock for perfection. Once earnings came out and disappointed expectations, the stock sold off and found support near the 391. Now it is consolidation near the 403-405 level. If the market continues to move higher, eventually a market stock like AAPL will be back in sync with the market price movement. When that happens, look for AAPL to break above the 427 and it might make some analyst’s price prediction near the 450 level to come true.

The overall tone of the market is positive and it is indicating the near term trend is up.