Today the SP500 finally closed above the 875 level that so many market participants and talking heads have been waiting for. During the last couple trading sessions, the market has been testing the 875 level many times, and one can sense the jitters and the rattled nerves when the market approach the 875 level. The price actions have been like a game of musical chairs. All the players in the game know the music will eventually stop. Some of the players are so nerve wrecked, they try to anticipate the stopping of the music by sitting down before the music actually stop. After they sat down and realized the music hasn't stopped yet, they get back up and follow the rest of the crowd until another nerve gets wrecked, and this process repeat itself until the music finally stop.

The price actions on Thursday, April 30, 2009 trading session is like a game of musical chairs with a bunch of nervous players. The market move above the 875 and some players decided to sell to avoid ending up holding the bag when the market sell off. After they sold, they realized the market is not ready to sell off, so they join back in with the rest of the crowd and push the market back above the 875. This process was repeated multiple times throughout the session.

Today, May 1, 2009, the music stopped. Five minutes before the close, SP500 was struggling to close with a modest gain at 873, then a last minute push was made to push the SP500 to close at 877.52. This last minute push to help the SP500 closed above the 875 level reminded me what took place on January 30, 2009 when a last minute push was made to prevent the DJI from closing below the psychological support level of 8000. We all know what followed after this artificially support was made for the DJI 8000 level.

So, here we go again. The market removed a question mark for the skeptics to enter the market by closing above the 875 level. How much conviction is behind this close above 875 on the SP500 will be revealed in the coming week. Is it a breakout or a head fake. If it is anything like the January 30, 2009 efforts to hold the DJI above 8000, then get ready for a wild ride down.

Since there hasn't been any dramatic changes in the daily charts, I have decided to put up the weekly chart to get a different perspective on the price levels. Here is the SP500 weekly chart:

The DJI weekly chart:

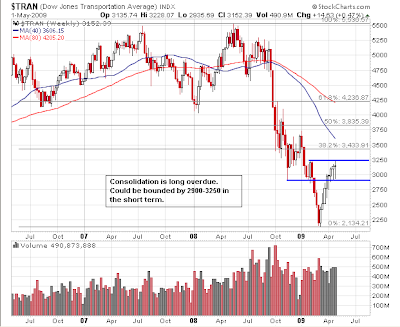

The DJT weekly chart:

The Nasdaq 100 weekly chart:

The Russell 2000 weekly chart:

The weekly charts show how these widely watched indices have been positive for multiple consecutive weeks. The market is definitely over extended, and with the SP500 finally closed above the 875 resistance level, it won't be long before the long awaited pullback to occur. When the pullback arrives, will it be a pullback or a reversal. While I'm waiting for the market to show its move, I will be managing my opened long positions with very tight stops and preparing to take the short side if the market decided to reverse.

Keep a close watch on the market next week and trade cautiously. Be on the lookout for increasing volatilities.