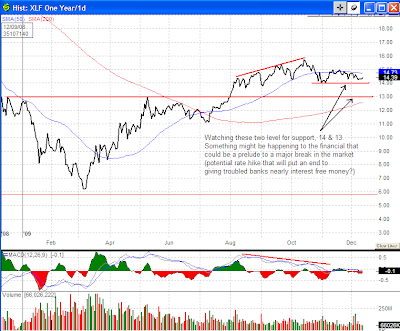

As the dollar gains strength, those dollar carry trades will be unwounded and that will bring to the end of this round of musical chair. To monitor the movement of the dollar, I have put up the following charts with key levels identified for potential breakout. In addition, I have also taken a closer look at the financial. It appears something might be developing that could cause a major break for the market. Whatever that might be, only time will tell. For now, one might take a look at some individual stocks in this sector, i.e. GS, WFC, JEF, JPM, MS, and BAC, to get a sense of the developing weakness in this sector. I will post more about the financial and some possible scenarios to watch for 2010. In the meantime, here are the charts. Click on them to get a larger view of the chart.

DXY

UUP

FXE

OIH

USO

GLD

XLF