Here we are, back to the level where the bears left the market at the end of January 2010. The bears gave the bulls the first two trading sessions in February to show their convictions, and what the bulls were able to put together was not impressive. The rally the bulls presented lack volume and lack trending power. Rally started out strong within the first couple of hours of trading, and then the rally fizzled into a range bound mode. This gave the bears confidence these rallies have no real buying power. After the bears pushed the market to a small loss and did not see the bulls come back to defend their grounds, the bears took control today from beginning to end. The bears took the market down at will with no bulls in sights to provide any resistance. The absent of the bulls in today’s blood bath indicates there are more downsides to come. Until a sign of buyers stepping in to put up a fight, the downward move will continue. Unlike when the market was moving up from July 2009 to November 2009, when there were bears fighting the tape in anticipate an overdue correction that prevented the market making a rocket launch move. This time, there are no bulls fighting the tape to anticipate a higher high because there is no catalyst for the bulls to expect the market to go higher…so expect the market to drop sharply and quickly. Where are those talking heads pushing the “green shoot” now!

Here is the updated chart for the Dow Jones Industrial, SP500, Nasdaq 100, and the Russell 2000. I won’t be fooled into thinking it is cheap to jump in and buy right now. I will wait for the dust to settles and let the bears finish with their rampage, then see if there are any bulls stepping in before I would start to consider going long. Until then, I will remain bearish.

DJIA:

SP500

SP500:

Nasdaq 100

Nasdaq 100:

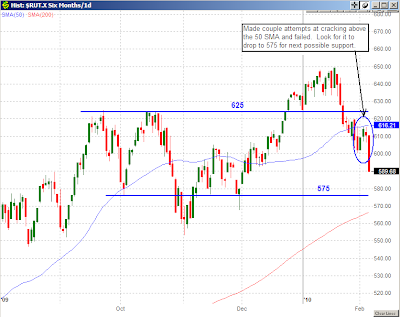

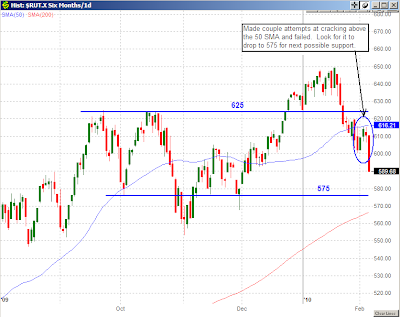

Russell 2000

Russell 2000: