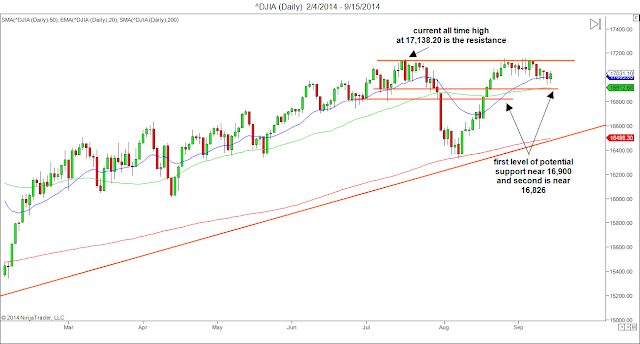

Here is the daily chart of the DJIA, the current all time high still remain to be the resistance, and support levels are near 16,900 and 16,826 if it decided to pull back along with the rest of the market.

(click on the chart to enlarge)

The SPX came down and tested the 1979 support level then bounced after it has dipped into the 1977 territory. If it retest the 1979 and failed to hold above it, then look for next potential support level near 1970.

NDX broke the 4061 support level and could be headed down to test the 3987 level for support unless it can retake the 4061 level.

Here are the charts for some of the stocks I have mentioned on Twitter on Monday.

SCTY gave back over 8% today and it appears it is ready to head down to test the 63 level. The potential resistance level is near the 76 level.

GOOGL broke the near term trendline and dipped down to test the 578 level and printed a doji hammer candle. If this doji hammer candle fails to reverse the recent down trend, then look for GOOGL to move down to the 570 level.

AMZN bounced back up after it has filled the 319 price gap. If the bounce unable to hold above 319, then look for it to go back down to test the level near 307.

NFLX broke the 473 support and could be headed down to test the 453 level for support. If it cannot find support at 453, then look for next potential support next near 434.

As I have stated at the end of my last post, the market remains to be in a pullback mode, continue to be defensive.

Disclosure: No position.