Looking at the daily chart for the DJI, it shows the DJI consolidated above the 200 SMA near the 8750 level then the DJI dropped below the 200 SMA and tested the 8500 level. Now it appears to be getting ready to move back above the 200 SMA. Key resistance level to watch is the 8750, it needs to move above this level in order to maintain its upward trend toward the 9000 level. If DJI fails to move above and hold the 200 SMA for support, the 8250 support level could be in play and this could be a sign the DJI is about to turn over.

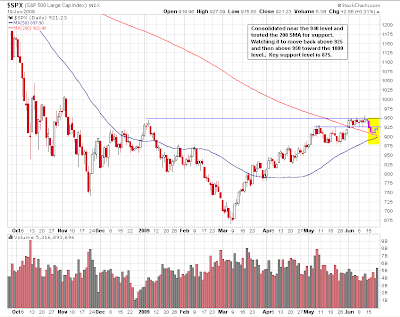

For the SP500, it has remained above the 200 SMA. It consolidated near the 940 level then retreated below the 925 level and tested the 200 SMA for support. It appears to be moving back up toward the 950. It is trying to clear the 925. The 50 SMA is also readying to cross over the 200 SMA. When it clears the 950 level, 1000 will be in sight.

The Nasdaq 100 came down and filled the early June gap and bounced off the May high. The strength in tech stocks continues to keep the Nasdaq 100 trending upward. First sign of caution will be if this index does not break above the 1510 level and retreats back below the 50 SMA.

I will continue to play on the side of strengths, which will be the tech. Being very selective on financial and transport. Avoiding energy as it is mixed and crude is extended. Also I will be reducing my position size until the major indices have move above the recent high. I will maintain a cautious bullish stance.