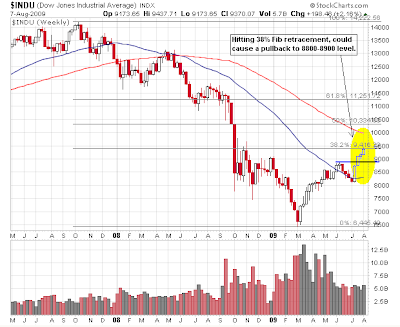

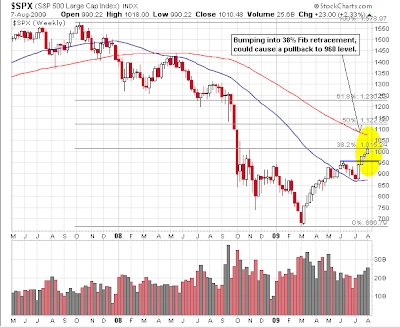

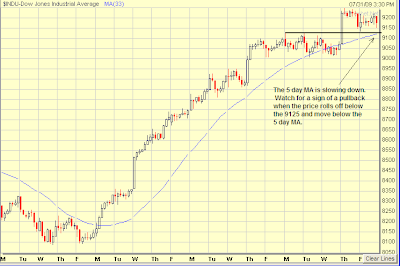

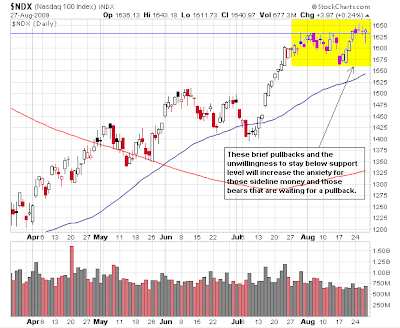

Unless the bears are able to push the market below its support level and move it down for more than a few hours and more than a single day, the sideline money will just continue to buy on the dips, and continue to move this market higher.

Lot of talking heads is still talking about how extended the market is and how the market is overdue for a pullback. The more these talking heads talk about the pullback, the more fuels are being added to help move the market higher. Soon after these talking heads give up the thought on the impending pullback, then from the rushing in of the sideline money and the beaten up bears running for cover, the market will enter the climatic topping phase and blow itself back into its primary down trend.