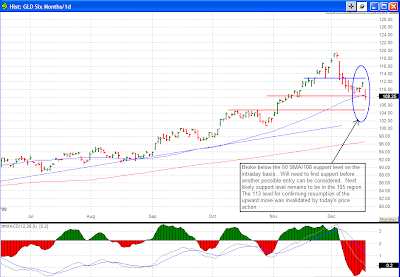

GLD

As the recent price actions from the US dollar telling us its imminent resurgence, the momentum took a leap forward and broke some major resistance today. Most of today’s drop in the price of gold was due to the strength in the dollar.

DXY

UUP

The Euro took a hit from the dollar, the Euro-dollar ETF, FXE, went below the 144 support level. If the dollar continue to regain its strength (which seem to be most likely at this point), then the unwinding of those dollar carry trades will start to accelerate.

FXE

I have mentioned the weakness in the financial sector previously, and I am continuing to be cautious on the financials. Take a look at the time frame when WFC and BAC did their secondary offering. Don’t get fooled by the false move. Their stock prices were being held up to move those papers. If one look closely at the financials, one can detect the underneath weakness in the sector. I’m staying away on buying the financials.

WFC