The SP500 closed well above the 2079.11 support level. It closed at 2104.18 with a gain of 26.61 or 1.28%, and the 2108.86 remains to be the nearest resistance level. If SPX breaks above this resistance level, then the next resistance level could be at 2124.20, which is the 6/23/15 close. The levels previously discussed as potential support are still valid. If the price reversed and dipped below the 2079.11, then the 2063.52 will be the next potential minor support. The major support levels lie within the 2044 to 2034 region.

SPX

(click on the chart to enlarge)

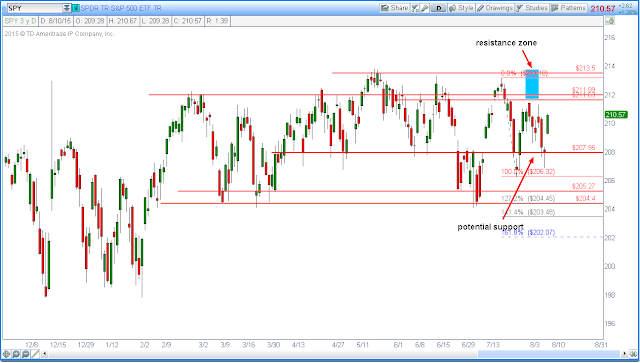

In term of the SPY, the level near 212 is the next potential resistance or target level, specifically the 211.63 and 211.99. The support levels are 207.95, 206.32 and 204.40 in that following order.

SPY

The Nasdaq 100 exploded to the upside and closed above the resistance zone between 4546 and 4562. The doji with long lower wick from last Friday’s price action gave us a hint that the buyers were back in force. The NDX closed at 4573.11 with a gain of 53.03 or +1.17%. The resistance level remains to be the 7/22/15 price gap at 4643.83, and the support levels are 4506.19 and the 7/13/15 price gap between 4456.54 and 4434.11.

NDX

The Russell 2000 moved above the short term resistance level of 1215.42. It closed at 1222.67 with a gain of 15.77 or +1.31%. The 1238.76 still is the near term resistance and the Fibonacci extension levels continue to be the potential supports.

RUT

The market was very resilient today. It was able to hold on to its gains without too much of backing and filling during the session. When the indices made their high of the day (HOD), their price action did not show any sign of exhaustive buying. Therefore, the market could continue with this rally for another day or two until it has reached a level where there is a lack of buyers. Until then, always be mindful that anything is possible, and expect the unexpected.