The DJI and NDX are the two remaining indexes still sitting above major support level. The SPX testing of the 8/24/15 low did not provide any confirmation of a low or an indication of the start of a new major downtrend.

The story is very different for the NYA and the DJT. These two indices continue to make new low. More importantly, they are sending cautionary messages along with deteriorating breadth. The DJT continues to tell us to monitor for possible new low from the DJI and the broad market index NYA is warning of more potential broad market decline.

The downside momentum appears to be accelerating, but still waiting for the market to send out confirmation of either an intermediate bottom has been made or a new major downtrend has begun. Until then, one might consider moving to the sideline since current market environment is more suitable for short term trading. Cash is a position.

Below are the charts for the indexes, click on them to enlarge to read the commentary.

SPX:

DJI:

NDX:

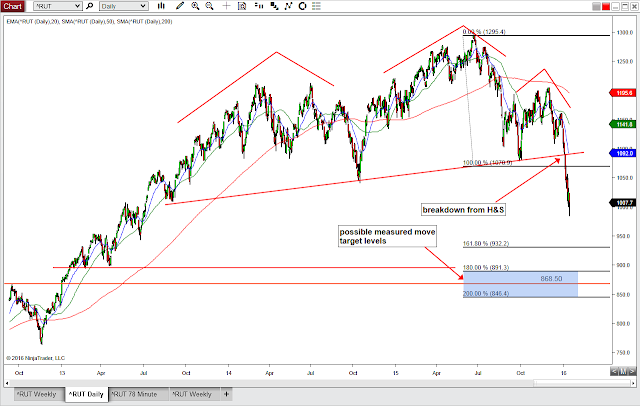

RUT:

NYA:

DJT: